Energy Market Update – March

Share

SHIFTING DYNAMICS

The global energy markets continue to navigate a landscape of shifting dynamics, with geopolitical risks, trade policy uncertainty, and supply-side developments shaping the outlook for crude and refined products. As we move into March, two major developments are catching market attention: the reaffirmed commitment of key OPEC+ producers to a gradual supply increase and the record-breaking U.S. crude production figures from 2024. These factors, combined with ongoing geopolitical tensions and trade policy concerns, set the stage for a volatile yet potentially opportunistic environment for fuel buyers.

OPEC+ producers, including Saudi Arabia, Russia, Iraq, and the UAE, held a virtual meeting on the 3rd March to assess market conditions. Despite previous expectations of prolonged supply restraint, the group cited improving fundamentals and a healthier market outlook as justification for proceeding with the gradual return of 2.2 mb/d in voluntary supply cuts beginning the 1st April. However, the group emphasised flexibility, making it clear that the increase could be paused or even reversed if market conditions warrant. This adaptability reinforces OPEC+’s role as a stabilising force, signalling their readiness to react should demand weaken or

prices falter.

At the same time, U.S. crude oil production set a new annual record in 2024, averaging 13.22 million bpd, according to government data. Monthly output also hit an all-time high in December, reaching 13.5 million bpd, largely driven by surging production in the Gulf of Mexico, which jumped 12% month-over- month to 1.86 million bpd. These gains contrast with a slight decline in output from key shale regions like Texas and North Dakota, raising questions about the sustainability of U.S. production growth in 2025.

Independent producers in the Permian, in particular, have shifted focus toward capital discipline and shareholder returns rather than aggressive expansion. This shift, combined with long-dated WTI contracts pricing in the low $60s, suggests limited incentives for further drilling, potentially capping future U.S. supply growth.

The broader supply picture is further complicated by geopolitical factors. The U.S. has revoked Chevron’s operating license in Venezuela, a move expected to curb exports by 200-300kbd, tightening global supply. Russian crude output remains restricted at 9.0 mb/d, due not only to OPEC+ commitments but also continued Ukrainian drone strikes on key oil infrastructure. Additionally, potential shifts in U.S. policy under a Trump administration could bring renewed sanctions on Iranian crude, further constraining supply. Taken together, these developments suggest that while headline supply numbers may look robust, hidden vulnerabilities remain that could impact availability later in the year.

U.S. TRADE POLICY

On the demand side, uncertainty surrounding U.S. trade policy continues to cast a shadow. The Trump administration’s increasingly aggressive tariff strategy raises concerns about potential economic slowdowns, particularly in trade-sensitive sectors such as aviation and shipping. Historically, trade tensions have led to weakened global demand growth, and while some view Trump’s stance as a negotiating tactic, prolonged tariffs could weigh on fuel consumption. Market participants will be watching closely for any shifts in policy that could impact GDP growth forecasts and, in turn, refined product demand.

Amid these mixed signals, market positioning remains a key factor to watch. The International Energy Agency (IEA) recently revised its oversupply forecast for 2025 downward to 450kbd, reflecting a tighter market than previously anticipated. Hedge funds are currently in a net-short position on WTI and Brent, suggesting room for a short-covering rally if sentiment shifts. With OPEC+ maintaining flexibility on supply adjustments, the U.S. facing potential production growth limitations, and geopolitical risks persisting, fuel buyers should consider risk management strategies while prices remain at attractive levels. The balance of risks suggests that while short-term volatility will persist, much of the bearish sentiment is already priced in. Any further dips could provide a compelling entry point for strategic price protection.

The coming months will be pivotal, with OPEC+ decisions, U.S. trade policy developments, and evolving geopolitical tensions all playing a role in shaping price trends. Businesses with exposure to jet fuel and marine fuel markets should remain agile, monitoring market movements closely and considering opportunities to secure price protection should further downside materialise before potential supply-side constraints begin to tighten balances later in the year.

TECHNICAL ANALYSIS

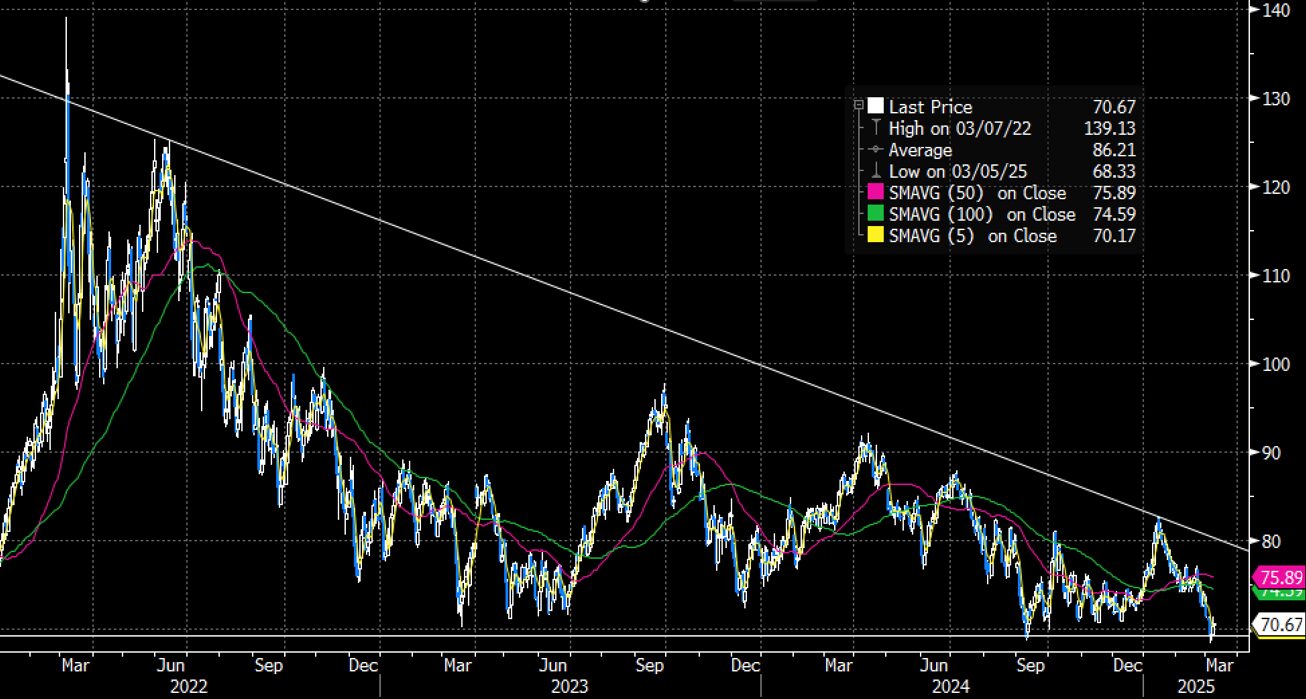

Brent is testing a key multi-year support level at $70/bbl. A decisive break down below this level could signal a significant shift in market structure towards a more bearish trend. However, long-term analysis indicates a converging pattern, with the potential for a breakout in either direction.

In the short term, prices continue to test support levels but have yet to break decisively. A rebound from this level could provide upward momentum, while a breakdown may accelerate further declines.

For more Paratus insights and content sign up here.

Disclaimer: The information in this document is provided for informational purposes only and does not constitute financial, investment, or insurance advice. Nothing in this document should be interpreted as a recommendation to purchase, sell, or otherwise engage in any financial or insurance transaction. The purchase of insurance is subject to formal contractual agreements, including Know Your Customer (KYC) procedures and binding terms with an insurer. Any financial analysis, worked examples, or illustrations are hypothetical and should not be relied upon as an indication of future performance or guarantees of any specific outcome. Market conditions are subject to change, and Paratus & Partners Ltd makes no representation or warranty as to the accuracy, completeness, or timeliness of the information provided. Readers are advised to conduct their own independent research and seek professional advice before making any financial or insurance-related decisions.

Paratus & Partners Ltd is authorised and regulated by the Financial Conduct Authority (FCA) under Firm Reference Number 955298. This document has not been reviewed or approved as a financial promotion.